“Liberation Day” has arrived and we, as customers and businesses leaders, are left to determine how to respond. Though published over a week ago, this Wall Street Journal video provides an excellent understanding of how the tariffs might affect the world. I will take liberally from this video a number of talking points and expand them to help you more fully understand the situation.

We are in new territory and a careful and thoughtful analysis is necessary to understand what is the best path forward for your business.

Bad Tariffs

Generally, I do not believe, as a company, in editorializing on the rightness or wrongness of trade or economic policies. It is outside of the purview of our organization. I believe that MTG should offer practical advice on the reality of the current economic climate, the same as we do for our clients when assisting them in transforming their manufacturing operations. “Yes,” we tell them. “Your manufacturing operations are not supposed to run like this. But they do, so we need to develop a solution based on the reality.”

However; this time is different. I will still provide insight into what your company can do to try to mitigate the impact of tariffs on our business and what strategies are available to respond to it. That said, let’s be clear that this is a bad policy change. It is bad for consumers, bad for businesses, bad for US economic goals, and bad for the world.

It is bad for customers because they will have to pay more for all kinds of goods and inflation will almost certainly increase.

It is bad for businesses because their costs will go up and they are likely to face lower demand for their products.

It is bad for the United States as it will disrupt our trade policies and slow economic growth. It could isolate the American economy and possibly threaten the value of the dollar as the global currency. More on that in future blogs.

It is bad for the global economy as it will depress overall demand and hurt trade as the dollar becomes more valuable. The US is still, by far, the largest economy and anything that it does will have global ramifications.

Yet we live in the real world and have to deal with the reality of the situation even if the decision was bad and counterproductive. Businesses must take the world as it is and adapt.

Tariff Basics

It is important to start with the basics. People need to understand what a tariff is and what a reciprocal tariff is. These are important concepts as they will inform the rest of the content in the series.

A tariff is a tax place on imported goods by the importing country. An easy example of how a tariff works would be for a toy. Assume a toy is produced in China for one dollar for an American toy company. The American company pays the Chinese manufacturer three dollars per unit. If there is a 50% tariff on Chinese manufactured toys, then the American company will need to pay one dollar to the Chinese manufacturer and 50 cents to the American government.

Companies usually pass on their additional costs to consumers. It will raise the cost to $3.50 per toy, or more likely, they will raise it higher to maximize profits. Consumers will pay higher prices per goods and the economy as a whole is likely to see inflation.

Despite any attempts to claim otherwise, a tariff is paid by domestic companies, and those costs are passed on to domestic consumers. It creates a worse position for consumers who pay higher prices. The foreign producers do not pay the tariffs; however, the tariffs are bad for them and the higher prices will suppress demand for the products. Additionally, the higher prices that consumers pay will not be paid to the manufacturer, so it does not receive any benefit. If the domestic company cannot lower its prices (for whatever reason) it will push the manufacturer to lower its prices.

It may sound like tariffs are all bad, yet they can serve useful functions. Until the advent of income tax, most government revenue was from tariffs and taxes on specific products. It can also be used to protect developing industries and critical industries.

Reciprocal Tariffs

Reciprocal tariffs are less focused and more tit-for-tat than generalized tariffs. These are tariffs that match whatever tariffs companies have on American products. In this case, if Madagascar has a 50% tariff on vanilla than the United States would levee a 50% tariff on vanilla from Madagascar. Very simple.

At a surface level, that sounds reasonable. Equal tariffs all around. While simple, it ignores the complexity of actual trade policies. Take the example provided here. The US does not produce vanilla, but Madagascar produces a lot. Madagascar does not suffer much, except fewer sales to the US, while the US is stuck with a much higher price for vanilla. Reciprocal tariffs basically let’s other countries dictate our trade policies.

They are also very complicated. There are over 5,000 items on the Harmonized Tariff Schedule. We currently have three types of tariffs: general, special cases (most favorited nations), and high discriminatory rates for non-WTO members like Iran. By applying different rates for different countries, we are looking at potentially 750,000 different tariffs (the six figure level) and over 3 million tariff levels for the more complete 10 digit level. It is a bureaucratic mess that will likely be even worse due to the mass layoffs that DOGE has undertaken. I have friends that worked for the Department of Commerce who have told me how keeping trade flowing smoothly is a difficult act at the best of times.

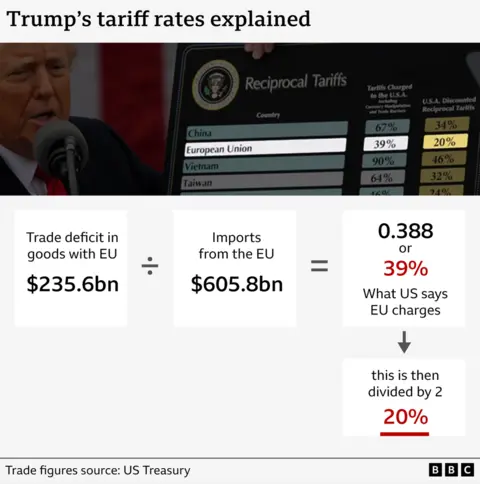

That is how reciprocal tariffs work. The current administration calculates it differently. Instead it uses a formula that takes the trade deficient divides the total goods imported and divides by two. Here is an example from the BBC how that works in practice:

This methodology is a poor representation on how trade works. The US may have large trade deficits for many non-tariff related reasons. Vietnam is a good example of that situation. It is a major exporter of consumer goods and, as a more developing country, is not a large market for US product such as agricultural goods, autos, airplanes, and advanced electronic equipment. It also applies to countries that are primarily exporters of natural resources. This system will not create freer trade and more equitable trade.

What's Next?

The topic of tariffs is too complex for this post so we will break in into other pieces. Over the next week, we will publish blog posts covering, at minimum, the following topics:

- Previous tariff regimes and why these failed

- Possible global response to this new tariff regime

- What should your company do?

There will be more blogs as we figure the full scope of these tariffs and what they mean for the economy and your business.

What can MTG do to help you improve your operations?